Dendreon (NASDAQ:DNDN)

Dendreon (NASDAQ:DNDN) is getting defended accross the board after the stock got hit (-20%) in after hours trading following The Centers for Medicare & Medicaid Services (CMS) issued a standard statement that it is now starting its national coverage analysis of Provenge to determine whether or not Provenge is reasonable

and necessary.

-

J.P. Morgan is reiterating their Overweight rating saying they view this as an attractive opportunity for patient, LT investors. This development has the potential to linger as an overhang considering it cranks up the decibels of an already noisy situation. Nevertheless they ultimately expect a favorable resolution given that Provenge is an FDA-approved treatment with a demonstrated survival advantage, was rapidly incorporated into NCCN treatment guidelines (indicating acceptance within the medical community), and is already covered by some private payors and local MACs:

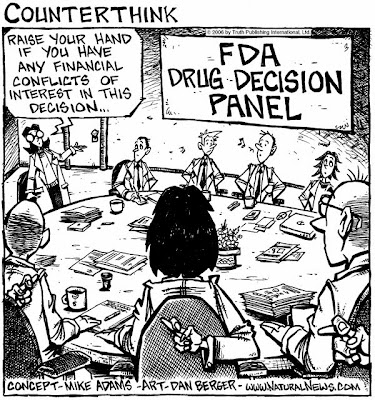

What’s an NCA? Medicare coverage is limited to treatments that are deemed “reasonable and necessary.” In some cases, CMS will initiate a NCA to determine if it should implement a National Coverage Determination (NCD) – a national policy statement granting, limiting, or excluding Medicare coverage. This news was surprising given that NCAs are generally not initiated on freshly approved drugs though our understanding is this is not a cost-effectiveness-driven exercise.

What are the potential scenarios? We see the worst-case scenario (outright refusal of coverage) as highly unlikely given Provenge’s overall survival benefit (esp. in pts 65+ yrs) and NCCN guideline adoption. Indeed, we are not aware of any NCDs for “on-label” oncology drugs (only off-label in CRC with Avastin/Erbitux/oxali and for Abarelix where coverage was restricted to the labeled indication). The best-case scenario would arise from a review that does not even proceed to an NCD. In the event there is an NCD that clarifies the on-label population for Medicare, we would actually view this as a positive as it essentially guarantees national coverage (and we only assume on-label use). A risk to note is this process could prompt some local MAC directors to stall coverage decisions until the NCA plays out.

We’re disappointed but remain OW. Investors may need a strong stomach (or some quality noise-cancelling headphones), but we remain confident that coverage of Provenge will remain intact following CMS’s review. We anticipate greater clarity post the MEDCAC meeting later this year. That said, we acknowledge this news is an added overhang to DNDN, which was already in the midst of a firestorm of controversy, and this event is unlikely to improve sentiment near term.

- Cowen's Eric Schmidt, Ph.D reits Outperform on Dendreon and highlights 5 reasons why Provenge should be covered and reimbursed by CMS:1. CMS covers all drugs that are medically necessary. There is essentially no debate that Provenge’s proven survival advantage and benign side effect profile are medically necessary for elderly men (the CMS population). The only other approved PRCA agents (taxotere and cabazitaxel) do not compare well to Provenge in terms of efficacy or safety.

2. CMS is forbidden by law to make coverage decisions based upon drug pricing. Provenge's high cost cannot be used against it. CMS cannot negotiate a lower price point for Provenge.

3. There is no precedent on CMS's part to even attempt to restrict coverage of cancer drugs in on label indication. All three prior NCDs convened to discuss oncology drugs (colorectal cancer therapies, Abarelix, Zevalin/Bexxar) were focused on off-label use.

4. A majority of states go as far as to require payors to reimburse for cancer drugs that are used off-label, but listed in the various Compendia.

5. President Obama doesn’t want to convene a Sarah Palin "death panel". Were CMS to even host MEDCAC panel that debates coverage for Provenge, the political fallout would be enormous.

We believe the national coverage decision (NCD) is being called to provide guidance to CMS's local Medicare Administrative Contractors (MACs) on Provenge. We believe the only politically acceptable outcome is coverage for on label use, though CMS might use the NCD to make it clear that it will restrict off-label use (not in street models). While Dendreon management was taken off guard by last night's decision to open an NCD, it doesn't expect the proceedings to have a material impact on Provenge's launch (CMS and other payors are likely to continue to reimburse the drug during the NCD process).

In fact a CMS spokesperson has said it is "99.9 percent certain that we will pay for it (Provenge) if somebody files a claim"We find it somewhat ironic that in an environment where wholly-owned oncology assets are highly coveted acquisition candidates (Osi Pharmaceuticals, Abraxis Bioscience) investors are fleeing shares of Dendreon.

Our thesis on DNDN is unchanged: we recommend shares based on Provenge’s $4B+ WW market potential and unique barriers to competition. We believe the shares can outperform the market by 100% over the next year.

- Baird & Co reiterates their Outperform rating and $64 price target (unch) on DNDN saying that while they understand the recent consistent drumbeat of Provenge launch concerns and rumors coupled with yesterday’s announced national coverage determination (NCD) on Provenge could give any investor pause, they believe the worst case scenario contemplated here – an official CMS ruling not to reimburse for Provenge – is simply not supported by the facts. With the stock indicated sharply lower in aftermarket trading, they remain aggressive buyers.

Three key points:First, cost effectiveness is not an issue here. While some concerns have been voiced over Provenge’s cost ($93k/patient), we note that CMS guidance documents indicate that cost effectiveness is not considered in NCDs (see CMS guidance here).

Second, CMS cannot second-guess FDA. Provenge has been approved by FDA to treat asymptomatic or minimally symptomatic metastatic castrate-resistant prostate cancer patients, and the MEDCAC review will not re-analyze FDA’s decision.

Third, the data supports the use of Provenge as “reasonable and necessary” in this population, in our view. CMS will likely consider whether Provenge is appropriate for Medicare patients (>65 years), and may limit reimbursement to only on-label use.

Looking at Provenge’s label, we point out that in a survival analysis of the Provenge clinical trials, 78% of patients were >65. In addition, median survival in patients >65 years of age was 23.4 months, versus 17.3 months for control (6.1 month survival benefit). This compares to an overall median OS benefit of four months, so it appears older patients in fact did better. Moreover, the label clearly states that there were no apparent differences in the safety profile of Provenge in patients over 65 and younger patients.

All things considered, we do anticipate the MEDCAC review will endorse Provenge reimbursement. It is also important to note that the initiation of a National Coverage Analysis does not impact fiscal intermediaries (such as Palmetto, etc.), which are already reimbursing Provenge, nor does it restrict local CMS contractors from covering the drug. With DNDN shares trading substantially below pre-Provenge approval levels, we remain aggressive buyers on weakness.

Notablecalls: Buy it, it's going to bounce. It's very likely to see $30 again today. The stock traded $25-26 in after hours.Why?

- Read this:

Factors CMS Considers in Opening a National Coverage DeterminationWho Can Request an NCD

- A. Requests by external parties

A request to make an NCD can be received from an individual or entity who identifies an item or service as a potential **benefit** (or to prevent potential harm) to Medicare beneficiaries.

.....

So, basically pretty much anyone can attempt to initiate a NCD. A possible competitor. A patient. CMS itself. A short-seller...

I happen to know that at least one very large biotech player that was heavily long into Provenge approval sold (& potentially reversed) his position in the name. And believe me, these guys can think out-of-the-box when it comes to trading, if you get the drift.

This is the business we chose. I tip my hat.

I suspect the coming ownership filings have an interesting story to tell.

- Is CMS really going to send out a message: Stop developing active cellular immunotherapies. They work, but they cost too much, so we're not going to pay for these ?

Most of Provenge patients are 65+ (men over 70 have a VERY high likelyhood of developing prostate cancer). Is CMS really going to deny access to this new wonder-drug that has given new hope to so many?

I say, Hell NO!

They may want to send out a message regarding off-label use but Provenge is so disease-specific that I doubt there will be much off-label use out there.

- As Cowen notes, OSIP & ABII got bought. Big pharma is salivating for these kinds of assets right now. At this valuation Dendreon is clearly a takeover candidate. Although I doubt they would sell out even at a 100% premium from here.

- The delay in CMS decision is a non-event as Provenge production wasn't expected to be in full-force til 2012.

Note that private payers, the Aetnas of the world are already paying for Provenge.

All in all folks, this is a chance to buy a very scarce biotech asset at 30c on the dollar. Use it. I'm not long but I'm planning adding Dendreon to my L-T portfolio as soon as today.

Bernstein's Geoffrey Porges is making a significant call in Biogen-Idec (NASDAQ:BIIB) downgrading the name to Underperform from Market Perform with a $51 price target (prev. $57)

Bernstein's Geoffrey Porges is making a significant call in Biogen-Idec (NASDAQ:BIIB) downgrading the name to Underperform from Market Perform with a $51 price target (prev. $57) Sixth, Biogen's flexibility to reduce R&D and SG&A spending and significantly improve margins seems to have limited additional scope. One of the key elements of bullish theses about Biogen is that their historically high R&D ratios (up to 31% in 2004) could be reduced dramatically with new management and a rejuvenated board.

Sixth, Biogen's flexibility to reduce R&D and SG&A spending and significantly improve margins seems to have limited additional scope. One of the key elements of bullish theses about Biogen is that their historically high R&D ratios (up to 31% in 2004) could be reduced dramatically with new management and a rejuvenated board.